Hello everyone welcome to our blog on ” How to become financially independent.” In today’s fast-paced world, financial freedom is something that many of us strive for. It means having the ability to live the life we want without worrying about money. whether it’s being able to retire early, travel the world, or start our own business, financially independent can make it all possible. Many of us think that we become financially independent when we get a job or start earning from other sources, but actually this is a wrong thinking about us. we can be financially independent before we start earning. In this blog, we will be discussing various strategies and tips to help you achieve financially independent. If you ready to take control of your finance start building the life you’ve always dreamed of, then keep reading!

What is Financial Independence

Financial independence refers to the freedom of living life in your own way without the pressure of having to work for money. It is the state of having enough wealth to fulfill the desire of yourself and your family, or to secure yourself for unexpected emergencies.

Some people who manage their finance in a smart way become financially independent. Once you achieve the goal of becoming financially independent, you will able to live your life in your own way without facing the problem of running short of money.

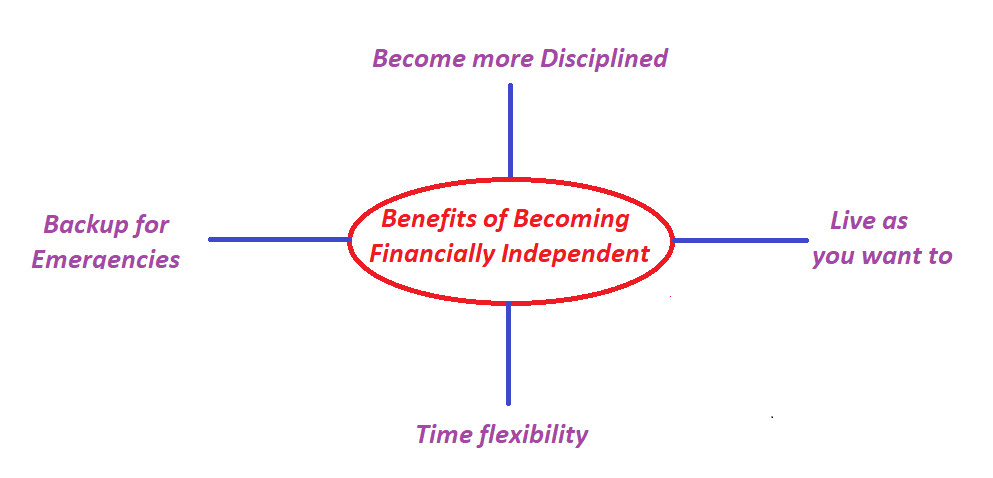

What are the Benefits of Becoming Financially Independent

we have already discuss the meaning of financial independence. Now lets us discuss the benefits of becoming financially independent.

#1.1 Backup for Emergencies

It makes you ready for unexpected financial emergencies in the future by having enough wealth to safely get out of the situation and also provides a sense of security and peace of mind.

#1.2 Become more Disciplined

Once you build the habit of saving and investing, you will automatically become disciplined in life. You will learn to spend money in smart way.

#1.3 Live as you want to

You can live life in your own terms, you have the freedom to make choices without being constrained by financial limitation. It’s make you enjoy your life.

#1.4 Time flexibility

You have the freedom to choose when and how you want to work, allowing yo to pursue your passion and interest.

How to save money

Generally people do Job and Business to sustain their livelihood. However, it is observed that despite earnings well, some people are not able to save money. In resent years, Pandemic like COVID 19 have also taught people the importance of saving money. Today we will tell you some ways to save money with the help of which you can manage your income better and save money.

#2.1 Set a Budegt

Budgeting helps you determine how you can allocated your financial priorities throughout the year and track how you are spending your income. budgeting, will help you identify areas where you can cut back and where you need to spend more. With budgeting, you will be able to achieve your priorities. budgeting will also help you identify areas where you are overspending, and where you can cut back. You can track this information by looking at your bank statement, and understand where you need to make changes with your spending habits. For example, f you find that you are spending a lot on eating, you can try to reduce this habit.

#2.2 Be Goal-Oriented

Chose one goal and plan to achieve it by the end of 2023. For example, you may want to save three times of your monthly expenses for an emergency fund, or save 20% of your pocket money (income) every month towards a down payment on a car. Setting a clear and specific goal and planning to achieve it by a certain date will give you something to work towards and help you to stay motivated. It is important to remember that achieving financial takes time and effort, but with persistence, and consistency, you will be able to reach your goal.

#2.3 Automate your Payment

Use automatic saving tools to achieve your saving goals. by doing this a certain amount of money will be transferred from your bank account to your saving account every month, according to your preference, whether it be a fixed amount or a percentage of your income. Automated saving is a great way to bust your saving. you can sit this up through your online banking or through payments app. Delaying payments can also be consider a form of saving. Automated saving and tracking your expenses will give you a sense of control over your money and will help you reach your saving goal. additionally, it’s important to enjoy the saving you have accumulated in your account.

#2.4 Things to Consider Other Than a Saving Account

Having a balance between too little and too much money in your saving account is also important. If you find that you have very little left after saving and budgeting, it can be frustrating. on the other hand, if you have too much money left, it may mean that you are not saving enough. it’s important to strike a balance between saving enough for your financial goals and not sacrificing your current lifestyle. It’s also important to have emergency savings for unexpected expenses. It’s good to review your saving and expenses regularly to ensure you are on track with your financial goals and make adjustments as needed.

#2.5 Get out of High Interest loan

Such loans carry higher interest rates, so efforts should be made to reduce them. By paying off the debt faster, you can get out of the loan trap faster. Prioritize paying off any collateral-related debts first. this will allow you to save more and have more disposable incime.

Making extra payments on large loans such as home loans can help you pay off your loan faster. You can also consider refinancing your loan with a higher interest rate to one with a lower interest rate. this can help you save money in the long run.

#2.6 Curb Your Spending

Make every efforts to reduce the expenses of your desires. the less you spend , the more you will be able to save. For example, do not use unnecessary online services or subscriptions plans and cancel them.

If your budget is tight

- Avoid buying unnecessary things.

- Cut down on luxuries and family expenses.

- Avoid brand loyalty

#2.7 Control Your Temper

Practice the 30- day rule to avoid impulse spending. if your desire for something is strong but it’s not a necessity, wait 30 days before buying it. this will help you save money and make more thoughtful purchase decisions.

After waiting, if you still want it, go ahead and buy it. however, by waiting, the desire may dissipate and you’ll save your money from wasted.

#2.8 Borrow wisely

When it comes to life style and consumption, focus on the essentials and prioritize them in your life. Be mindful in unnecessary expenses.

Being mindful of unnecessary expenses that creep up on credit card bills can improve your ability to save money.

#2.9 A Proper Strategy Regarding Expenses

Make the most of available benefits for you. Use free trials and discount available online. Be mindful of recurring payments or recharges that you may have forgotten about on credit card bills and cancel them. Look for deals that align with your lifestyle needs.

For example, if you do online shopping, looks for deals that will save you money on your favorite online purchases or offer on exclusive discounted reward.

#2.10 Challenge Yourself

Saving money is not only important but also being smart with the savings. If you’re already saving 10% of your money, try to increase it to 20%. If you already saving 20%, try to increase it to 30%. The goal is to continually save more and be mindful of how you use your savings.

In order to achieve this, you will need to consistently maintain your discipline, through which you will be able to control your temptation, achieve your goals, and maintain your balance.

#2.11 Protect your money

In the end, take care of the security of your savings. you do not want to be in a situation like loss of savings due to unfortunate incidents.

Take health and life insurance to secure your and your family’s money during the ups and downs of life.

FAQ

How Many Years Does it Take to Become Financially Independent?

| Ans :- Having considered those disclaimers, the mathematical result is that financial independence occurs when your assets are equal to your expenses divided by 4%. In other words, Assets = Expenses / 0.04 = Expenses * 25. Once your assets are 25 times your expenses, then you’re financially independent and able to retire at any time. |

How do you create passive income?

| Ans :- Ideas of passive income– 1.Open a High Yield Savings Account. 2.Invest In a Business. 3.Become a Peer-to-Peer (P2P) Lender. 4.Buy a Rental Property. 5.Invest in Crowdfunded Real Estate. 6.Invest in Index Funds or Dividend-Paying Stocks. 7.Invest with an Automated Advisor. 8.Start a Retirement Account. |

How to make money online?

| Ans :- some ideas of earning money from online 1.Pick up freelance work online. … 2.Test websites and apps. … 3.Pick up tasks on Amazon’s Mechanical Turk. … 4.Take surveys for money. … 5.Make money from your blog as an affiliate. … 6.Sell your wares on Etsy. … 7.Get advertising revenue from your blog or YouTube channel. … 8.Become an Instagram influencer. |