Before entering into the stock market, you must have some basic knowledge about the stock market. Why would anyone invest in the stock market where the chances of losing your initial capital are very high. You might have heard from somewhere that in the stock market you can earn 2 times, 3 times or more than your investment. But here the biggest question arises that how one can earn in share market. Here I am explaining you step by step from basic to advanced. let’s start

what is share market?

Stock market is a platform where people can buy or sell company shares that are listed on the New York Stock Exchange (NYSE) or Nasdaq. The stock market is also known as the share market. When a company wants to raise its capital, they distribute some percentage of their shares through IPO, for this they have to register on the stock exchange, for example NYSE and Nasdaq.

Share market is an important part of the financial system as it helps the companies to raise their capital whenever they need to grow their company on a large scale. It also helps common people to get a chance to invest in stocks and become financially independent. The stock market can also be a volatile place, with prices fluctuating depending on a variety of factors including economic conditions, company performance and market sentiment.

why invest in share market?

We invest in the stock market to build our wealth for our future in the long run. While some people say where the stock market is a risky investment and compare it to gambling. People make losses in the stock market due to lack of knowledge. Several studies have shown that investing in equity shares for the long term (five to ten years) can generate returns that beat inflation and are a better option than gold and real estate.

Some of the key points of investing in the stock market are–

High return potential:

The stock market has the potential to provide higher returns than other investments such as savings accounts or bonds.

Diversification:

Investing in the stock market can help in diversifying the investment portfolio, which can help in reducing the risk.

Convenient:

Online stock trading is simple, and a lot of brokers include mobile apps that let you manage your money on the road.

Ability to beat inflation:

Over the long run, the stock market has often outperformed other assets, which can help beat inflation.

Professional Management:

Many individuals invest in mutual funds or exchange-traded funds (ETFs) that are managed by professional fund managers, who make investment decisions on the fund’s behalf.

Types of share market

the share market can be classified into two ways, namely Primary and Secondary —

Primary Market :-

“When a company raises funds through the stock market for the first time, it is known as an initial public offering (IPO). In an IPO, a company issues shares of stock to the public for the first time in order to raise capital. After the IPO, the shares of the company are listed on a stock exchange and can be bought and sold by the public.”

Secondary Market :-

“The secondary market is where existing securities are bought and sold by investors. This is typically done through stock exchanges such as the New York Stock Exchange (NYSE) or the Nasdaq. In these markets, investors buy and sell shares amongst themselves at an agreed-upon price. The issuing company does not receive any proceeds from the sale of the securities in the secondary market. A broker usually acts as an intermediary to facilitate these transactions.”

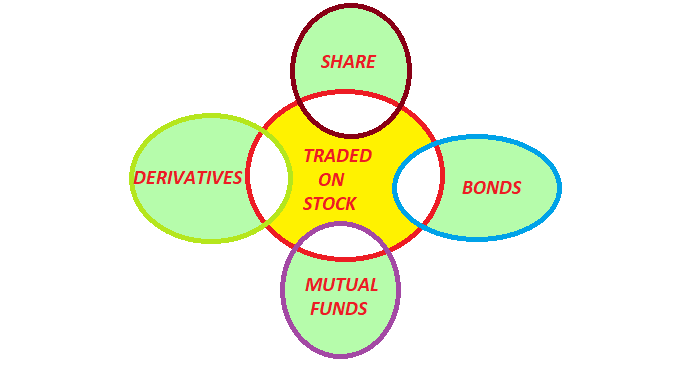

What is Traded On Share Market

There are four categories of financial instrument that are traded on stock market. These include –

Share

A share is a unit of ownership in a company that represent a portion of the company’s assets and profits. when you buy share of a company, you become a share holder and have a claim (proportional to the number of share you own) on the company assets and earnings. As the company grows and generate profits, the value of your shares may increase, providing you with capital appreciation. Additionally, some companies pay dividend to their share holders, which are payments made out of the company’s profits.

Bonds

A company’s ability to undertake and long-term projects is dependent on having sufficient capital. One way to acquire this capital is by issuing bonds. Bonds are financial instruments that allow corporations, municipalities, and governments to raise funds by promising to repay the bondholder a specific amount and to pay interest over a set period of time. when a bond is issue the bondholder become a creditors of the company and is entitled to receive regular interest payments, also known as coupons. from the bondholder’s perspective, these bonds serve as a source of fixed income as they receive a guaranteed rate of interest and the return of their invested amount at the maturity date.

Derivatives

A derivatives is a financial contract whose value depends on or “derives” from an underlying assets, such as stock, commodity, currency, or index,. derivatives are used to manage financial risk or to speculate on changes in the value of the underlying assets. the most common type of derivatives are option and futures contracts.

Mutual Funds

A mutual fund is a convenient and effective way for individuals to invest in a diversified portfolio of securities, including stocks, bonds, and money market instruments. The funds come from many investors, pooling their resources to create a larger and more varied investment portfolio. The management of the mutual fund is overseen by a professional fund manager, who has the expertise and experience to make investment decisions that align with the fund’s stated investment objectives. The objective could be anything from capital growth to income generation. By investing in a mutual fund, individuals can benefit from the expertise and diversification of the fund manager and achieve their financial goals.

How to invest in Stock Market

Here are the steps to invest in the US stock market:

| 1 | Open a brokerage account: Choose a reputable brokerage firm and open an account to trade stocks in the US. |

| 2 | Fund your account: Transfer money from your bank account to your brokerage account to fund your investment. |

| 3 | Determine your investment goals: Decide how much you want to invest and your risk tolerance. |

| 4 | Research stocks: Research and analyze US companies and their stocks before investing. |

| 5 | Make a diversified portfolio: Spread your investment across different US stocks and sectors to minimize risk. |

| 6 | Place your order: Use the brokerage’s platform to place an order to buy or sell stocks. |

| 7 | Monitor and review regularly: Keep track of the performance of your US stocks and adjust your portfolio as needed. |

| 8 | Seek professional advice if needed. |

Remember to invest for the long-term and never put all your eggs in one basket.